Item: “Cobalt Loses Its Wings”

IThe sky is less blue for cobalt. When the price of the metal was floating in the sky on the Cote d’Azur a year ago, it suddenly stopped and nosedived. Since January, the air pocket has accounted for almost a third in value. Cobalt is in trouble… It is currently trading at around $34,500 (€32,135) a tonne on the London Metal Exchange. The comparison is even more brutal if the cursor is placed on the spring of 2022: the $80,000 ceiling was exceeded then, following the accelerated ascent of the blue metal.

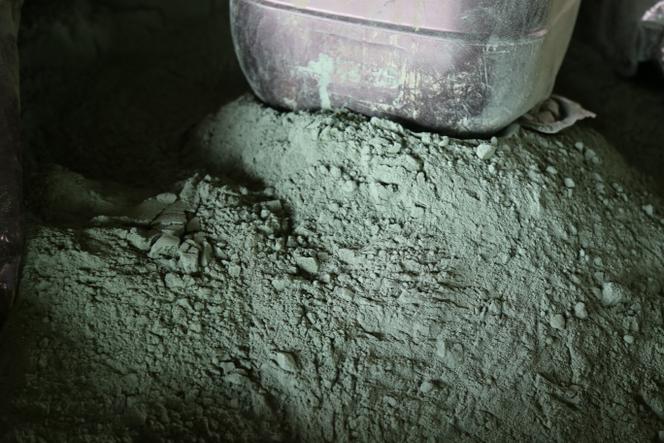

Investors jump at the sight of a dead former star. Ball trap on cobalt. But, to explain this settlement of financial accounts at the OK Corral, they are not short of cartridges. They emphasize the overproduction of these raw materials. In 2022, extraction of this co-product from copper and nickel mines is at full speed, and volumes are said to have increased by more than 20%. Another element in investors’ eyes: consumer appetite has slowed. The slowdown is caused, in particular, by less dynamism of the electronics industry. Going from a deficit to even a moderate surplus causes markets to tumble.

However, the attraction of this metal, described as “electric”, remains strong. Players are too excited about the prospects of selling batteries for electric vehicles. Because if a few grams of cobalt slip under the shell of a smartphone, the gauge goes into kilograms under the hood. Maneuvering room is tight for the automotive industry, which is concerned about its supply. Especially since three-quarters of the volume of cobalt comes from the rich subsoil of the Democratic Republic of Congo (DRC). A country where mining conditions are tainted by corruption and the use of child labor. An ethical conundrum for builders.

Congo jackpot

Tensions have risen over Congo’s cobalt gold mine. DRC President Felix Tshisekedi wants to revise the 2008 mining agreement with China. Cobalt and copper against infrastructure construction, is the barter contract fake? The DRC wants to increase its stake in the Sino-Congo mining joint venture Sicomines and better secure its interests. A dispute also arose with Chinese group CMOC over what were deemed insufficient royalties for the operation of Tenke’s Fungurume mine. From July 2022, Congolese authorities suspended exports until the dispute was resolved in April. The stored metal must now flow…

Source: Le Monde

Leave a Reply