How Telecom Develops Fintex with Personal Play

Martin Heine, Telecom’s Director of Digital Growth in Argentina, presented to this media the current status of his project and how it differs from other digital proposals.

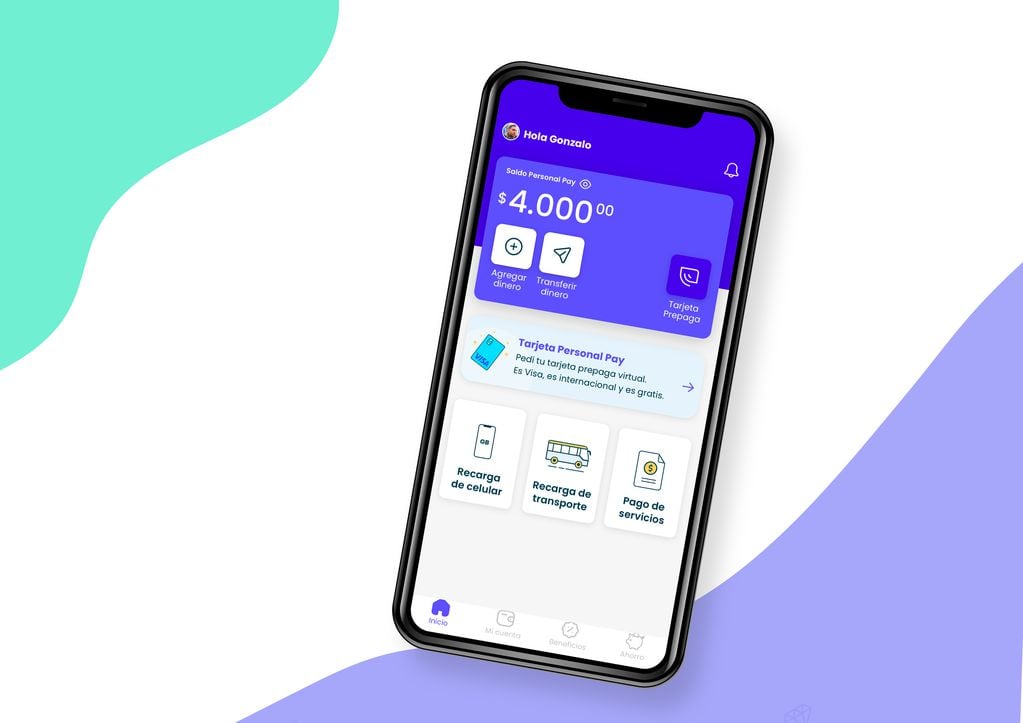

Earlier this year, Personal announced that its own virtual wallet was already available in beta development: Personal Play. With the idea of continuing to enhance the development of digital finance (Fintech) and add new features, the application is free to use and has no opening or maintenance costs. Months later, Martin Hein, director of digital growth at Telecom Argentina, told Los Andes how the project is progressing and how they plan to become a multi-platform service ecosystem.

What trends are you observing in digital means of payment?

Argentina is a country where the interest rate on cash transactions is currently high (around 60%), for this reason. We are confident that the possibility of transferring these transactions to digital media could increase significantly in the coming years.; And that consumers do not have to use cash.

The same goes for the banking of the population, especially those who have less access to traditional banking where the rate does not exceed 50%. We want to enable personal payWith a proposal that is very firmly focused on simple transactions, savings, support, security and that the customer comes with us to make money.

How does this virtual wallet contribute to this?

In telecom Our goal is to become an ecosystem of services and platforms that, along with connectivity, make life easier for our customers., Which is why we have made progress in developing new business units. Personal Pay was born as part of this strategic vision to continue to provide full connectivity to our customers through today ‘s virtual wallet solution.

This is a challenge that pushes us to the Fintech market, one of the fastest growing markets in recent years in the country. Via PersonalPay We strive to facilitate the financial involvement of Argentines by offering a differential service.

In addition, from the core of our service – connect- During these years We have created a continuous investment program It has also enabled us to connect with different parts of the country and facilitate the entry of new customers (Individual as well as small and medium business) Digital financial market. We believe that using our virtual wallet improves our services and our customersBecause those who use Personal Pay and are also customers of the company have more benefits, discounts and payouts on services, invoices, recharges and purchases.

What importance do you attach to this region in the project?

Personal Pay is a Personal wallet solution developed by Telecom Argentina. You do not need to be a client of the company or a specific field to use Personal Pay, But is available to all users who want to make digital transactions with their money from anywhere in the country. This allows you to pay, save and manage money efficiently and securely.

Via PersonalPay Users can add money to their account by transfer or cash payment from authorized recharge centersReset your mobile phone (regardless of which company they have), pay for transport cards and pay for services, send and receive money via QR code, and receive a wide range of discounts and benefits.

In this regard, what challenges await personal play?

To have our Personal Pay Wallet We work with some external providers, but the vast majority are done with our own talent. Personal Pay is a clear example of the evolution that Telecom Argentina is undertaking in terms of digital business, which aims to consolidate the company as a platform ecosystem, in terms of value as a differential quality.

This transformation It also involves the continuous inclusion of digital talent, which adds value to the team. For personal payment cell as well as other digital business that the company is promoting, Telecom continues to recruit local talent, challenging them to become the protagonists of one of the most important digital transformations in the region.Who take advantage of the integration of high-power teams and passionately create digital services that change the lives of millions of Argentines through technology.

What other projects or initiatives are you working on?

As for the development of our wallet We will continue to enhance the functionality of the application and in future versions users will have access to the tools Savings, QR Payments, Loans, Consumer Loans, Investments, Financial Education and many more that you can view and experience directly from our app.

The company works daily to develop and identify new products and services related to technological innovations.From IoT-based solutions to products for large enterprises that facilitate business operations, we aim to bring strategic evolution from a traditional company to a multi-platform ecosystem of digital services. We are on that path.

Personal game usage and benefits

Martin Heine explained that Personal Pay has gone through various phases of developmentAfter it had proof of concept, after the closed beta phase, they reached the open beta and today they are entering a new, more consolidated phase with the opening of a large market. The Director of Digital Growth of Argentina Telecom has listed several uses and benefits For users:

– Access to key features such as pay, send, receive and transfer money.

– Have a free virtual and physical Visa prepaid card to use anywhere in the world.

– Pay all your taxes.

– Restart your mobile phone and your transport card.

– Send and receive money with QR code.

– Set savings goals.

All this adds to the wide range of refunds, discounts and benefitsSuch as refunds every week, every day for items such as supermarkets, movie theaters, fast food, fuel, discounts on top brands, and savings of up to $ 10,000 in the Personal Store.

In addition, if they are Personal Flow clients, they have special benefits such as:

– Up to 20% on their personal flow taxes, ie they save on their services every month.

– They always have an extra 30% on all recharges of their personal line.

– and if they are personal users, the app will not consume data from their plan.

Source: Losandes

Leave a Reply